Yeah that's what I thought when I first saw the thread title.

Buffalo Bill Rule #1: it rubs the lotion on it's skin, it does this whenever it's told.

Buffalo Bill Rule #2: it rubs it's lotion on it's skin, or else it gets the hose again.

Buffalo Bill Rule #3: then it puts the lotion in the basket.

ΜΟΛΩΝ ΛΑΒΕ

"So live your life so the fear of death can never enter your heart. Trouble no one about their religion; respect others in their views, and demand that they respect yours. Love your life, perfect your life, beautify all things in your life. Seek to make your life long and of service to your people. Prepare a noble death song for the day when you go over the great divide."

"Finish today what others won't, so you can achieve tomorrow what others can't."

Complete crap. Buffet is more than welcome to volunteer to pay more taxes here's the link

http://www.treasurydirect.gov/govt/r.../gift/gift.htm

Also if he wants to make an impact, why is he giving away all his fortune to charities instead of the government? Oh wait, even he knows the gov will waste it.

The tax will just roll down hill to everyone below. That's why the rich are rich, they know loopholes and hire attorneys to shield themselves.

At the risk of botching this again, here are a few of my relevant observations regarding the proposed rule.

The proposed revision to the capital gains tax code is not going to make the sky fall down. It would benefit anyone interested in this to read up on some of the findings made by the Tax Policy Center over the past decade regarding research into, well, tax policy in United States (as if that wasn't evident enough). The core of the argument centers around a wealthy individual's propensity to a have a large majority of their income come from capital gains as opposed to personal income. The prime reason this applies to Warren Buffet is because the majority of his income is from cap. gains (and Brad, don't say that Buffet is an idiot. The man is widely regarded as one of the best playing the game). IIR, he paid around 17.7% taxes on income compared to the 28 or whatever percent bracket his secretary is in.

Keep in mind that there are also different brackets for capital gains dependent on your personal income bracket, so I reckon that by and large (confirmed in Obama's speech) this will strictly be targeting those will incomes $1m and above. Good or bad? Reduced growth, GDP, jobs, foreign capital withdrawal?

When we talk job growth, we have to change views and look at it from the perspective of the corporation, at which we can really simply the matter down to the cost of capital to the firm. Generally, we are only talking about a handful of sources: venture capital, debt (bonds), preferred stock, and common stock. Right off the bat, it is pretty easy to identify that without argument, bond and common stock financing is certainly going to be hurt by this. Rates on bonds will certainly be driven upward as investors require additional compensation for the increased taxation, and holders of common stock will likely hold onto their shares, waiting for the next Republican administration to undoubtedly reverse this decision, if it gets passed. What about venture capital and preferred stock? Venture capital, from what I can recall, is sourced mainly from LARGE groups, such as college endowment funds, pension funds, insurance and casualty groups, and private foundations. Although I won't dig through the tax code to find the particular revision, feel free to double check my statement that these groups do NOT fall under the umbrella of capital gains taxation and are effectively exempt from paying it. Preferred stock holders, the majority of which are other corporations, only have to pay capital gains on at most 30% of their gains (can be a small as 0% depending on many factors such as corporate income). Since venture capitalists often fund start-ups as well as large issues of IPO, the increased capital gains taxation will not affect that portion of the economy. The point here is that while the marginal costs of financing to the firm may increase slightly because of this, I recon that in the long run, the net affect to the corporation will be to just eat a small increased cost for the time being, as they have no other choice. We may see a small shift into preferred stock, but these can also be somewhat of a moot point since firms often issue convertable preferred with a call date, essential forcing the corporate investor to convert to common stock before the call date.

What about an ill affect on GDP? The Tax Policy Center also did a 2005 study, which I read recently for Uni, attempting to find correlation between GDP growth and fluctuations in capital gains taxation since 1960. Net result? They were unable to find any statistically significant correlation between GDP growth and the capital gains rate.(Source). As noted in the study, Burman also tried the same thing while account for up to 5 years of lag time to market and found no statistically significant correlation.

At the moment, I can't really think of any specific implications for foreign capital investment, other that any withdrawal of capital is a net detriment to us as a host economy. Unfortunately I was unable to find any up-to-date data regarding the amount of foreign capital in the US, but more capital in a host economy leads to a more competitive market with lower costs (greatly simplifying the issue).

The bottom line of this argument, to me, is simply efficiency. I believe there are more efficient ways of fixing the system (tax code overhaul) as opposed to patching one leaking hole. That being said, I definitely agree that a raise in capital gains taxation is something that needs to be done, however it have been observed in a 1990 study by the Joint Committe on Taxation that the "revenue maximimizing" capital gains rate is 23% (Source). As I said above, the crux of the issue is efficiency cost, a concern also mirrored by the Tax Policy Center. In their words: "Yes, raising taxes on a couple hundred thousand of the highest-income Americans sounds awfully appealing. But narrowly based tax increases often come at an efficiency cost. And in this case, the most likely source of efficiency loss comes from discouraging realizations of capital gains." (Source)

inb4beingwrongabouteverything

KX65

Dizzer

929 - Yard Sale'd

A top campaign adviser to President Obama made clear Sunday that the president has no plans to chip in extra money from his own income to defray the deficit -- and would insist that the tax system itself be changed so that the wealthy pay more.

The president and first lady Michelle Obama paid an effective rate of 20.5 percent on gross income of $789,674, a lower rate than the president's secretary -- who earned less than $100,000.

The 20.5 percent rate is also less than the 30 percent Obama wants top earners to pay under the so-called "Buffett rule."

http://www.foxnews.com/politics/2012...#ixzz1sDBBc9nD

Hypocritical commie.

You wanna know what the chain of command is? It's the chain I go get and beat you with until you realize I'm in command.

http://online.wsj.com/article/SB1000...674519416.html

Nothing the government EVER does will save money. Ever.

and there it goes...

http://www.cnbc.com/id/47064357/Sena..._Rule_on_Taxes

KX65

Dizzer

929 - Yard Sale'd

Are you the least bit surprised by this?

Typical partisan BS.

Obama knows full well that a bill such as this stands no chance, it's ill-conceived and does nothing to curb the growing deficit.

But now he can go and claim that the "big bad right" is stopping all his progress.

Go 'Merica!!!

Do not put off living the life you dream of. Next year may never come. If we are always waiting for something to change...

Retirement, the kids to leave home, the weather or the economy, that's not living. That's waiting!

Waiting will only leaves us with unrealized dreams and empty wishes.

What ever happened to politicians trying to do the right thing on taxes - make taxes fair; balance budget. Is this REALLY the last president to understand that (see link)??? Now we have the tax-and-spend Dems and the cut-tax-and-spend Reps. All in the name of driving that divisive wedge between the voting populace to make sure you have the numbers you need come November... Fuck em all.

http://www.presidency.ucsb.edu/ws/in...#axzz1sK4ulclP

1989 Honda Hawk,2005 crf250x supermoto

It is better to communicate good information than to offer misinformation in the name of good communication. Alastair B Fraser

http://www.huffingtonpost.com/jared-...b_1431187.html

This word "fairness" keeps coming up around tax day, particularly in discussions around the Buffett rule.

Many have questioned what I and others mean by "fair." I've got five answers. A fair tax system should be:

- Progressive: those with more income pay a larger share of it in taxes;

- One that doesn't exacerbate inequality by giving preferential treatment to the wealthy (e.g., by favoring capital over labor income);

- One that doesn't disproportionately benefit those who are already doing the best at the expense of the rest;

- One that raises enough revenue from those with lots of resources to provide a leg up for those at a disadvantage;

- One that does not rearrange the pretax income distribution, as in a confiscatory, highly redistributive system.

Conservatives invariably counter that it's not fair for 47 percent of households to pay zero federal income tax (most recent data from 2009).

I even got a pretty moving note from a guy who said he didn't think it was fair that just because his income was so low, he didn't get to pay federal taxes. He wanted to contribute! (The usual Republican talking point here is "well, why don't you write a check to the Treasury?!" which is just silly. Whether it's this big-hearted low-income citizen or Buffett himself, their point is clearly systemic, and while their actions alone might make them feel better, they won't cure the perceived problem they're identifying.)

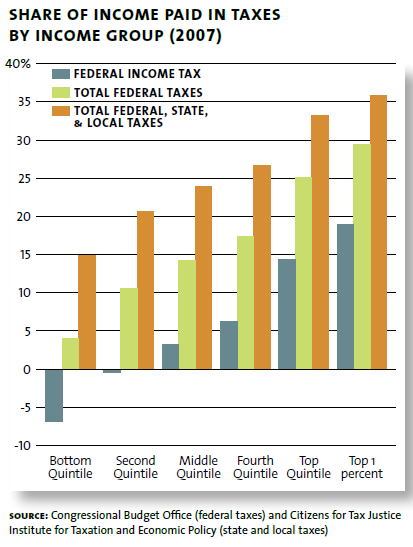

Liberals counter with two points. First, as the figure below shows, almost everybody pays taxes, and in fact, when it comes to payroll taxes, the middle class pays a higher effective rate than the wealthy (because those taxes cap out at around $110K). Middle and low-income households pay an effective rate of about 9 percent on payroll taxes; the top 1 percent pays 2 percent; middle-income families pay 17 percent of the total payroll tax bill; the top 1 percent pays 4 percent. And state tax rates tend to be pretty flat.

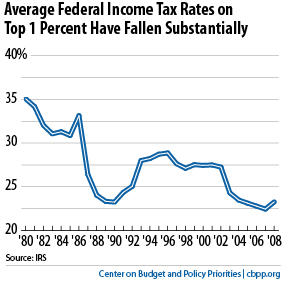

Source: Aron-Dine Second, as the next figure shows -- and these are important data points in reference to the first fairness principle above (progressivity) -- the actual effective tax rates of the wealthiest families (taxes paid as a share of income) have fallen quite sharply, because a) supply-side tax cuts from the Reagan and GW Bush-era only partly offset by Clinton's progressive changes in '92, and b) their pretax income has grown so much more quickly than their tax liability.

In other words, the wealthy have been paying a larger share of federal income taxes not because their tax rates have gone up -- in fact, they've gone down. It's because they've been collecting the lion's share of the growth for decades.

A key factor here has been the large decline in the rate of taxation on asset-based income, like capital gains, and the much increased concentration of that income among the wealthiest families. Those changes are related -- once you advantage a particular income type, you're going to see more of it. And these dynamics are also related to the bubble and bust syndrome in which we've been stuck, along with the financialization of the economy, both of which are problems to be discussed another day... let's stick with fairness for now (though I could see another principle here: a fair tax system doesn't incentivize the underpricing of risk, leading to busts that invariably whack the have-nots who are then called upon to bail out the haves; in practice, this principle would militate ending the favored treatment of debt financing in the tax code... hey, I like that... let's call it principle #6!).

Anyway, that's the rationale for claiming the Buffett rule increases fairness: it partially repairs the diminished progressivity with respect to certain millionaire+ households, specifically those with most of their income from capital as opposed to wages.

Now, you might object to progressivity, but I'd argue you're starting from a different place than most of us. Sure, you'll find folks to agree with you -- advocates of the flat tax might join you, for example. But those of us invoking fairness are generally invoking the progressivity that has always been a bedrock feature in the federal income tax.

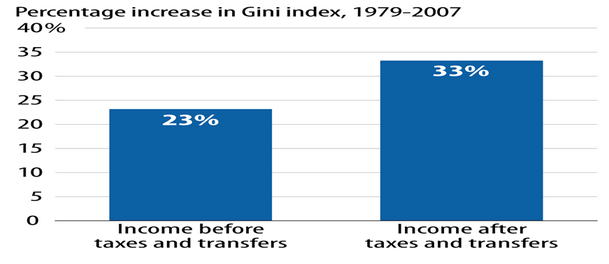

And that is as it should be, particularly in an era of so much pretax income inequality. The fact that tax code has become less progressive in a period when the pretax income distribution has become more unequal is another dimension of unfairness -- a violation of principle #2. The figure below shows that the system of taxes and transfers (which are, of course, related as the former pays for the latter) has become less of a bulwark against inequality over time. It shows that inequality grew 10 percentage points faster after taxes and transfers than it did before.

Source: CBO I won't go through all the above principles, other than to say that #4 is clearly in trouble and this redounds to #3. Were we to follow the roadmap in the House Republican budget -- for that matter, any Republican, supply-side, trickle-down tax plan -- we would very much be violating those two principles, as these reverse-Robin-Hood schemes redistribute upward.

It's not simply that these plans lower taxes on the wealthy much more so than they do on the poor. It's that they leave us with too little revenue to help offset the disadvantages that block the opportunities of the least well off, that provide them a safety net in hard times, that help them meet basic needs of food and shelter. It is not at all hard to connect the dots between regressive tax changes and cuts in Pell grants, nutritional assistance, retirement security, and pretty much everything else.

Finally, despite all the predictable caterwauling, the only tax fairness principle that seems intact is #5. If you were rich or poor before tax day, you'll be so again tomorrow. Of that, you can be certain.

Faster, faster, faster, until the thrill of speed overcomes the fear of death.

~Hunter S. Thompson

http://www.huffingtonpost.com/2012/0...n_1423547.html

President Obama's so-called Buffett Rule is supposed to make certain that top-earning Americans don't pay taxes at lower rates than their assistants.

But there are still ways for the country's wealthiest to escape their tax share under the measure, according to Bloomberg. Yes, the new rule would tax millionaires at higher minimum rates of up to 30 percent while eliminating many loopholes. But savvy taxpayers could focus a larger percentage of their portfolios on tax-free investments, such as municipal bonds and employer-based health insurance, neither of which require taxes on subsequent interest. They could also reportedly time the sale of their assets to get bigger tax breaks.

The rule has lately been the focus of lawmakers in Washington. Estimated to generate $47 billion in federal revenue over the course of a decade, it has also become one of the centerpieces of Obama's re-election campaign, cited by the President as a necessary measure to pay off the country's mounting deficits.

The new policy bears the name of the man who inspired its creation, Berkshire Hathaway CEO Warren Buffet, who has spoken out against an American tax code that allows him to pay taxes at a lower rate than his secretary.

Obama has also recently been joined by other super-rich Americans and their assistants in support of the mandate. One of those supporters, hedge fund manager Whitney Tilson, recently wrote in a Washington Post op-ed that he agreed with the policy because of "basic fairness." Tilson reiterated Buffett's basic point to Bloomberg: that even though his income is 39 times greater than that of his assistant, he still pays taxes at a considerably lower rate.

Democrats have pushed for the measure, which is expected to hit the Senate by next week, while many Republicans have railed against what they describe as an act of “class warfare.’’ GOP nominee Mitt Romney's campaign said on Monday that increased taxes on job creators will harm the national economy, according to The Boston Globe. Romney and his wife have also recently come under scrutiny for their own tax return. The couple paid 13.9 percent on their $22 million earnings in 2010.

On Friday, the Obamas disclosed that they paid an effective tax rate of just more than 20 percent.

Faster, faster, faster, until the thrill of speed overcomes the fear of death.

~Hunter S. Thompson

From the article:

"And Schumer said that Republican Party's likely nomination of former Massachusetts Gov. Mitt Romney in the presidential race will only raise the pressure because his and his wife's effective income tax rate on earnings of nearly $22 million in 2010 was just 13.9 percent."

Unless my math is wrong but basically 14% of $22 Million in earnings is $3,080,000.00 in taxes paid.

I guess I'm not seeing what the big deal here is? Romney paid way more than I'll ever pay in taxes(I'm not disclosing what I pay in taxes but suffice to say, between Federal and State combined it's around 17.5%) and I still didn't pay 1/100th of what he paid.

Yeah I'm pretty cool with that. I don't mind paying what I pay. Romney pays his fair share, just like every other super wealthy person does. I mean damn people, how much money to you want to take from someone else?????

P.S.

want to make it fair?? how about a 15% Flat Tax across the board for everyone. Someone making minimum wage pays 15%, someone like Mitt Romney pays 15%. Pretty fair??

Minimum wage gross: $15891(based on a 26 pay periods in a year)

Mitt Romney: $22,000,000

15% of each(rough figures):

Minimum Wage Earner - $2383.56 in taxes paid

Romney - $3.3 Million in taxes paid

Pretty fair????

I think so...

Or do we still need to tax the rich more, just because they are rich and have money and others don't???

Last edited by The Black Knight; Tue Apr 17th, 2012 at 03:28 PM.

ΜΟΛΩΝ ΛΑΒΕ

"So live your life so the fear of death can never enter your heart. Trouble no one about their religion; respect others in their views, and demand that they respect yours. Love your life, perfect your life, beautify all things in your life. Seek to make your life long and of service to your people. Prepare a noble death song for the day when you go over the great divide."

"Finish today what others won't, so you can achieve tomorrow what others can't."

Remember BK

"Fair" is the new "Take more from that guy and not me"

Do not put off living the life you dream of. Next year may never come. If we are always waiting for something to change...

Retirement, the kids to leave home, the weather or the economy, that's not living. That's waiting!

Waiting will only leaves us with unrealized dreams and empty wishes.

ΜΟΛΩΝ ΛΑΒΕ

"So live your life so the fear of death can never enter your heart. Trouble no one about their religion; respect others in their views, and demand that they respect yours. Love your life, perfect your life, beautify all things in your life. Seek to make your life long and of service to your people. Prepare a noble death song for the day when you go over the great divide."

"Finish today what others won't, so you can achieve tomorrow what others can't."

You cannot raise the poor into prosperity by taxing the rich out of prosperity.One that raises enough revenue from those with lots of resources to provide a leg up for those at a disadvantage

There must be, and will always be, dividing lines of income and success. You just have to make sure you possess the work ethic to be on the side that lives well.